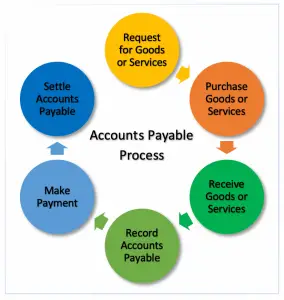

Accounts Payable Process

Accounts payable process usually starts with the request of the goods to be purchased to the purchasing department or the responsible personnel  until the payment is made to the supplier of goods or services. The accounts payable process may involve seven steps including:

until the payment is made to the supplier of goods or services. The accounts payable process may involve seven steps including:

- Request for Goods or Services

- Purchase Goods or Services

- Receive Goods or Services

- Records Payable

- Request for Payment

- Make Payment

- Settle Accounts Payable

Request for Goods or Services

The first step of accounts payable process usually starts with requesting the goods or services to be purchased. In this step, the important procedure is the authorization that is usually required for any purchase request.

The purchase request may come from the warehouse staff who control the stock or the personnel that need goods or services to be provided in the day to day operation of the business. And it usually needs approval from authorized personnel that can be the warehouse manager or those in the purchasing or administration department.

Purchase Goods or Services

Usually, the purchasing department is the one that is responsible for purchasing goods or services for the company. If there is no purchasing department, the purchasing responsibility usually goes to the administration department.

In this second step of the accounts payable process, after receiving the approved purchased request, the personnel responsible for purchasing usually start seeking quotations from different suppliers (usually 3 suppliers). Once the quotations obtained, there is usually a meeting to decide which supplier to choose for purchasing based on the price and quality of goods or services.

After selecting the supplier, the personnel that is responsible for purchasing will make the purchase order and send to the supplier to order goods or services.

Receive Goods or Services

The accounts payable process after sending the purchase order to the supplier will continue when the company receives goods or services from the supplier.

In this case, when the company receives goods, the person receiving goods will match the purchase order with the actual quantity of goods received and create receiving report or goods received note and send to the accounting department for recording.

For the services, there is usually a contract that states the term and condition of services, hence there is no receiving report in this case.

Record Accounts Payable

Under the accrual basis, the expense incurs when the company receives goods or services; hence, the company should record the liability here.

Likewise, the accounts payable process here is where the accountant will record accounts payable as liability using the purchase order, receiving report and supplier’s invoice. The journal entry for accounts payable will be as follow:

| Account | Debit | Credit |

|---|---|---|

| Inventory/Fixed Assets/Expenses | 000 | |

| Accounts payable | 000 |

Sometimes, there is no available invoice for the recording yet even though goods have been received. In this case, the accountant should still record the accounts payable by using only purchase order and receiving report as the expense already incurred.

Make Payment

After recording the liability, the accounts payable process continues when the company needs to make payment to settle such liability after the liability incurs for a certain period, usually at the period close to the due date or at the due date.

Usually, the accountant will have the responsibility to monitor the due date of the payment and request for payment to settle the liability. In this case, the accountant will make a payment voucher and request approval from the authorized personnel such as the finance manager or CFO.

Before making payment, the accountant should make should that all three supporting documents including purchase order, receiving report and supplier’s invoice, are available for verification.

For example, the accountant needs to verify that the quantity of goods in the receiving report is matched with the supplier’s invoice and the price in the supplier’s invoice is matched with the purchase order. This verification is called the “three-way matching” process.

Settle Accounts Payable

After making payment for settling the liability, the accountant needs to record transactions to reverse accounts payable. In this case, the journal entry is as follow:

| Account | Debit | Credit |

|---|---|---|

| Accounts payable | 000 | |

| Cash | 000 |

In this step of the accounts payable process, the accountant needs to check official receipt or receipt voucher as well as bank transfer slip or copied cheque, if payment is made by bank transfer or cheque, as supporting documents.