Risk Coverage Ratio

Overview

Risk coverage ratio is the ratio that measures how prudent the company is for its credit risk by showing what percent of the portfolio at risk is covered by actual loan loss reserves. It is usually used in the bank or microfinance institution to measure how much the company prepares for the worst.

The ratio of 100% or above means that the company have sufficient loan loss reserves to cover its portfolio at risk. The higher the percentage usually means that the company is more prudent.

However, this doesn’t mean the lower coverage is always bad. Sometimes, the low percentage of risk coverage ratio is due to most of the company’s loans are backed by the collateral. Hence, it causes the loan loss reserve to be small which leads to the result of the low coverage.

Risk Coverage Ratio Formula

Risk coverage ratio can be calculated by using the formula of dividing loan loss reserves by loans in arrears for 30 days or more plus refinanced loans.

In the calculation of the risk coverage ratio, refinanced loans need to be added with loans in arrears as the denominator. This is due to the non-performing loans are usually converted back to performing loans when they are refinanced.

Risk Coverage Ratio Example

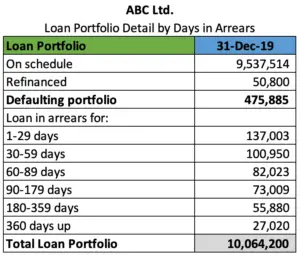

For example, ABC Ltd. which is a microfinance institution has USD 10,064,200 of the total amount of loan portfolio with the loan loss reserves of USD 430,879 and a detailed loan by days in arrears as in the table below.

Calculate risk coverage ratio for the above loan portfolio information.

Solution:

With the financial information in the example above, we can calculate the risk coverage ratio as below:

Loan loss reserves = USD 430,879

Loans in arrears for 30 days or more = 100,950 + 82,023 + 73,009 + 55,880 + 27,020 = USD 338,882

Refinanced loans = USD 50,800

Risk coverage ratio = 430,879 / (338,882 + 50,800) = 110.57%

So, the risk coverage ratio is 110.57% which means that the company has sufficient credit risk protection in its reserves.

The excel calculation, as well as the form and data in the picture of the example above, can be found in the link here: Risk coverage ratio calculation excel