Subsequent Event

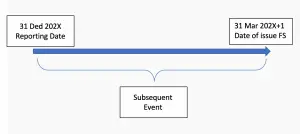

Subsequent Event is the event that occurs after the reporting date but before the date of issue financial statement. As usual, the date of issue annual report is around two to three weeks after the reporting date. It depends on the size and complexity of the company business. And it also depends on the auditor who signed on audit report as well as the audit fieldwork. The big company may require a longer time to audit the financial statements.

To understand more deeply, please check the following terms below:

To understand more deeply, please check the following terms below:

- Reporting date: is the date of financial statement or the balance sheet date.

- Date of auditor report: is the date that auditor signs on the audited report.

- Date the financial statement is issued: the date that audited financial statementes are issued to the public.

The financial statements may affect the event after the reporting date, and it is very important for the readers. Without proper disclose or adjustment, it will mislead the information. The event can be favorable or unfavorable to the company’s performance.

The company still be able to provide disclosure in its financial report, which depends on the type of subsequent event. Not all events requires to disclose in the annual report.

Type of subsequent event

Not all subsequent event requires to disclose or make the adjustment to the financial statement. There are two types of subsequent event which can be found below:

– Adjusted event

Adjusted event is the event that requires the management to modify their financial statement. As it will mislead the reader if we still issue the original statement. These events have proved that the financial statement does not reflect the real situation. The event provides additional information regarding the condition of items in the balance sheet on the reporting date.

For example, Company A has an ongoing lawsuit with the competitor regarding the patent. Based on the lawyer, there is no contingent liability as at the balance sheet date. However, one month after that the court has order company A to pay 10 million dollar penalties regarding this lawsuit.

In this scenario, management needs to modify the financial statement to record expenses and additonal liability.

– Non-adjusted event

Non-adjusted event is the subsequent event that does not required to modified the financial statement. However, some events require to disclose in the audited report in order to ensure the user has aware of these events. Not all events are required to disclose in report.

For example, Company A has report inventory balance of 10 million dollar in its balance sheet. They have provided proper provisions base on the accounting standard. However, one month after, most of them have been destroyed in the fire. So what should we do with this event? Should we write off inventory in the balance sheet?

This is the unadjusted event that does not required to modified the report. There is no indicator of an accident during the year-end and client already provides proper provision. But we need to provide disclosure in the audited reports to let the user know about this accident. This information may impact the user decision.

Example of non-adjusting event

The events which not require to modified financial statement include:

- Business acquisition or combination

- Business revaluation change due to exchange rate movement

- Damage of company assets due to an accident which is unpredictable

- The sale or buyback of share equity

Audit Procedures to identify subsequent event

The management has full responsibility to identify any subsequent event and make proper actions. It may require to adjust financial statements or provide disclosure.

Auditor responsible to review management assumptions over the subsequent event. The financial statement must reflect proper adjustment if they meet the criteria to be adjusted.

- Review management procedure to identify the subsequent event

- Inquiries with management and those in charge of governance if any events impact to the financial statements.

- Review accounting record after reporting date

- Check shareholder and management minute of meeting

- Review any outstanding lawsuit and result

- Review the interim report and other management reports if any.

It bases on auditor judgment and professional skepticism in order to identify any implication. Some of them may have an impact on the financial statement and require adjustment or disclosure.

In the last steps, the auditor will require the management or those in charge of governance to provide a written representation letter as the audit evident. The letter proof that all subsequent events after reporting date have been reviewed and adjusted or disclosed. Auditor will not responsible if any events have been concealed by the management.

Subsequent Event disclosure

Non-adjusted events should be disclosed in the financial reporting only if they are important to the readers and it will impact their decision. The disclosure must include the nature of the events and their impact on the financial statement if possible. If we cannot estimate the impact of event, we must state in the statement.

Company should disclose the condition which is uncertainty at the end of reporting date and reflects with new information received after the reporting date.

Going concern Issues After the End of Reporting Period

The company should not prepare the financial statements base on going concern basis if the management intends to liquidate the company or cease the majority of the operation after the end of reporting date. It means after the year-end, management knows their company going to liquidate. They can not prepare financial statements on going concern basis. They may prepare financial statements on other basic such as Break up basic.

Other Examples of Subsequent events

Bad Debt Expense

Company’s major customer has declared bankruptcy after the reporting date. As a result, the company lost around $ 200,000 of outstanding Account receivable. Company A already provides provision base on their internal policy.

What should we do with such kind of subsequent event?

It is the non-adjusted event as we have no additional information on the reporting date. However, we should provide full disclosure on the nature of event.

Dividend

Company B prepares a financial statement for the year-end 31 Dec 202X. On 31 Jan 202X+1, company pays a dividend to shareholders amount $ 10 million. Is it an adjusted event?

This is not an adjusted event and it has no impact on the financial statements, but management must disclose it in a note on retained earning.