Write Off Ratio

Overview

Write off ratio is the ratio that is usually used in microfinance institution or bank to measure the written-off loan in percent comparing to the company’s loan outstanding. When the loan is written off, it means the company is highly unlikely to receive back the remaining money that was lent.

In accounting, gross loans and their relative provision reserves will be removed from the balance sheet when they are written off. Normally, total assets, expenses, and profit are not affected as the written off event is usually made on the loans that already had made 100% provision.

Usually, the company is advised to write off the loans that are determined to be unrecoverable. This is to prevent the unrealistic inflation of the gross loan portfolio by those loans that may not be recovered.

Although loan written off doesn’t look good for the company, it can improve the outlook of the company’s portfolio at risk. For example, the portfolio at risk ratio tends to be smaller after the loan write-off event.

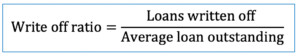

Write Off Ratio Formula

Write off ratio can be calculated by using the formula of loans written off dividing by the average loan outstanding.

- Loans written off: it is the written amount of loan during the accounting period.

- Average loan outstanding: loan outstanding at the current period plus loan outstanding at the end of the last period and divide by 2.

Write Off Ratio Example

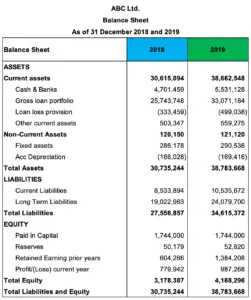

For example, we have the balance sheet of ABC Ltd. which is the microfinance institution below:

In 2019, the company had written off loans of USD 184,970 in amount.

Calculate write off ratio in 2019.

Solution:

With the financial information above, we can calculate write off ratio as below:

Average loan outstanding = (25,743,748 + 33,071,184) / 2 = USD 29,407,466

Write off ratio = 184,970 / 29,407,466 = 0.63%

The excel calculation and data in the picture of the example above can be found in the link here: Write off ratio calculation excel