Return on Investment

Return on investment (ROI) is a tool measure financial profit received from the investment. It is the performance measurement to compare many investments projects. It is very useful to measure when there are multiple investments with limited funds. Company can calculate ROI by using the returns of one investment over initial cost. The result will show as the percentage, the higher, the better.

Return on investment is very important for investors as they need to know their expected profit after injecting capital. They will access company past performance and the potential return. This is the first thing that investor needs to know before committing any fund to company. The investors also have their own expected rate of return, hurdle rate, so the company ROI must be higher in order to convince them to invest with us. As they have to give up the opportunity cost of investing with others.

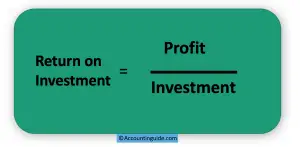

Return on Investment Formula

The return on investment can calculate as below:

The return on investment can calculate as below:

Return on Investment = Profit / Investment cost

ROI = (Revenue – COGS)/COGS

ROI = Investment Gain/Cost of Investment

Return on Investment Example:

Example 1:

Group Company A purchases a whole business of company B for $ 5m. After several years, company B makes a profit of $ 100,000 per year. Calculate the return on investment of Company A from buying company B.

ROI = $ 100,000 / $ 5,000,000 = 2% per year.

Example 2

Company A runs a business by import the product from China and sells in the US. In October, the company purchases the following:

- Product Cost $ 50,000

- Transportation $ 5,000

- Agency cost $ 2,000

- Other costs $ 5,000

All the products sold within the same month for $ 100,000.

We can calculate the return on investment as below:

ROI = (Revenue – COGS)/COGS

= (100,000 – 62,000)/62,000 = 61.29%

Example 3

Mr. A purchased 1,000 shares of Apple’s stock in 2016 when it was $ 100 per share. He decided to sell all stock when it reaches $ 150 per share in 2017.

Please calculate his return on investment.

The return on investment is:

ROI = Investment Gain/Cost of Investment

Cost of investment = 1,000 share x $ 100 per share = $ 100,0000

Gross return = 1,000 share x $ 150 per share = $ 150,000

Investment Gain = 150,000 – 100,000 = $ 50,000

ROI = $ 50,000 / $ 100,000 = 50%

What are the advantages of Return on Investment?

| Advantages of Return on Investment | |

|---|---|

| Measure the competition in the market | ROI allows the company to compare many projects and select the best one. Moreover, due to its popularity, management will be able to benchmark ratio in market as well. Even management selects the best option available within company, but it may be lower than the market. If so, it is more profitable to invest in other companies. |

| Simple and effective | As mention in the formula, the calculation is very simple. It does not involve any huge data as well as a complicated system. It is very easy to understand even the people outside the finance department. |

| Minimize the conflict of interest | The higher rate, the higher the return the company makes. By using it as the tool to evaluate investment project, it will ensure that management will work for the company best interest. It helps to confirm both the company and managers to follow the same goal to maximize shareholder wealth. |

| Breakdown segment or division performance | It helps the company to evaluate the performance of division or region by using ROI. They will be able to decide whether to sell or expand the operation of those business units by looking at the potential earning or growth. |

What are the Disadvantages of Return on Investment?

| Disadvantages of Return on Investment | |

|---|---|

| The time factor is ignored | In ROI calculation, each project period is entirely ignored while based only on the return. It may have a higher return, but take a long time to archive that target. A top profitable project may turn into a lower profit when take into account the time value of money. |

| Profit is subjective | Accounting profit is very subjective. It can manipulate by accounting policy, accounting estimate, and management judgment. They can reduce depreciation expense by setting a long useful life to increase profit. They will provide a lower allowance for bad debt even it is not reasonable. For the revenue at the year-end, they can increase or decrease base on an accrual basis. Managements will try to ensure that each annual profit is to meet the target. If it is too low, it is good to increase accrue revenue. If it is already over the target, they will push revenue to next year. The list will go on when management intends to manipulate the financial statements. |

| Hard to compare with other company | Due to the differences in accounting treatment in each company, it will be hard to compare ROI. As we can see from the previous point, the profit can be various base on each company. It is the same as investment cost, and some may use initial investment while others using net book value, fair value, and so on. |

| Encourage management to invest in short term project only | When adopts ROI model, management will consider only a short term over the company’s long term benefit. Only short term ROI will impact their current performance, while the long term project takes too long to show the result. So they will sacrifice the long term company benefit over short term one. Even some projects have a high return to shareholders in a long time, and they will be not selected. Some investments will increase the core value for companies such as new products, new markets, expansion in the new regions. For sure, they will reduce the current ROI, but it will provide long term benefits for shareholders. |

| Discourage management from making new investments | When new investments made, the total investment will increase, so the current ROI will decrease. It will not change much if new projects can provide immediate returns. Investment in a new IT system, fixed asset, factory, and product line will unlikely to generate profit in the short term. But if we do not make them on time, we will face a serious issue even impact company going concerned. |

Type of Return on Investment

When the investors make investments, they expect the return. The return may come in one of the following forms:

Interest

If they decide to invest in bonds, term deposits, and savings, they will receive a fixed interest base on the agreed term. This type of investment are very low risk as well as the return and the investors know exactly how much the will make over time.

Dividend

When they invest in the stock of any company, they will expect to receive an annual dividend base on company performance. With this investment, they don know exactly how much they going to receive as the dividend.

Capital Gain

If the investors are able to sell financial instruments for more than what they have paid, they will make a capital gain. On the other hand, if they sell lower than what they have paid, there will be a capital loss.