Balance Sheet

Definition

Balance sheet, or statement of financial position, is one of the four financial statements which shows the company’s financial condition at a given point in time. In general, a balance sheet is prepared by following the applicable accounting standards such as US GAAP, IFRS, or Local GAAP. Also, it is usually prepared the end of the accounting period, which could be monthly, quarterly, or annually.

Balance sheet provides information to the users, such as shareholders, investors, lenders, and suppliers, about the company’s financial health at the end of the accounting period. In this case, the users can use the balance sheet, together with other financial statements, such as income statement and statement of cash flows, to make a business decision involving the company. For example, lenders may decide whether to provide a new loan or more loans to the company only after looking at financial statements and other ratios, such as liquidity ratio and gearing ratios.

Balance Sheet in Accounting Equation

Balance sheets in various types of companies, whether it is manufacturing, trading, or service company, have three main components which are assets, liabilities, and equity. Additionally, they all follow the same accounting equation which is assets equal liabilities plus equity.

Assets are what the company owns in the business including cash, accounts receivable, inventory and equipment, etc.

Liabilities are what the company owes in the business including accounts payable, interest payable and notes payable, etc.

Equity is the owner’s investment in the business including the owner’s initial investment in capital and investment from accumulated profit from the previous year and current year profit etc.

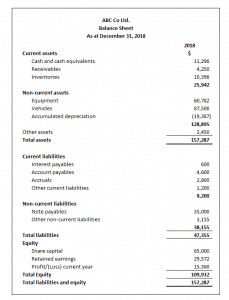

Example of Balance Sheet:

Classification in Balance Sheet

The company usually presents a classified balance sheet by separating current and non-current assets and liabilities. Likewise, assets are arranged in a way that separates more liquid assets, which can be converted to cash quickly, from less liquid assets. In a similar way, liabilities are arranged in a way that separates the liabilities that are soon to be paid from long-term liabilities.

| Classification in Balance Sheet | |

|---|---|

|

Current Assets |

Current assets are the assets that can be converted into cash within one year, including cash and cash equivalents, inventory, and accounts receivable. Cash refers to cash that the company has and can use anytime, including cash on hand, cash in the bank, and petty cash. Inventory refers to goods the company has and ready for sale, raw materials, or other unfished goods that will be used for sale after they are finished. Accounts receivable refers amount customers owe to the company for the goods delivered or services provided. |

|

Non-Current Assets |

Non-current assets are those assets that are not classified in current assets. In this case, they are the assets that the company expects to use for longer than one year in the operation of the business. They include lands, buildings, equipment, vehicles, and long-term investments, etc. |

|

Current Liabilities |

Current liabilities are the liabilities that the company needs to pay off within one year, including interest payable, accounts payable, accrued expenses, and taxes payable. Interest payable refers to the interest that the company needs to pay to its lenders within one year. Accounts payable refers to the amount the company owes to its suppliers for the goods delivered or services provided by the suppliers. Accrued expenses refer to the expenses that have already occurred to the company, but the company has not made payment for yet. Taxes payable refers to the tax liabilities that the company needs to pay to the government within one year. |

|

Non-Current Liabilities

|

Non-current liabilities are those liabilities that are not classified in current liabilities. In this case, they are the liabilities that the company needs payback in the period more than one year from the balance sheet date, such as notes payable that the company owes to the bank. |

It is useful to take note that notes payable are usually classified into both current and non-current liabilities. Current notes payable are those which are due to be paid within one year, while non-current notes payable are those which are due to be paid in a period longer than one year.