Decision Rule

Decision rule is a guide that helps management to decide base on the effectiveness, consistency, and principle of business operation. Different companies will have different judgments on the effectiveness of each decision. It is hard to make an absolute conclusion on any decision made.

In order to make the proper decisions in business, the manager needs to consider downsides, possibly loss or risk, and the result, which is the possible reward/gain as the consequence of the decision. All of these concerns are part of the decision rule, which will be discussed below.

Based on the same information, different people may come up with different decision outcomes due to their attitude toward risks and rewards. We classify them as risk adverse, those who trying to avoid risk, and risk-seeking, people who willing to accept higher for higher rewards.

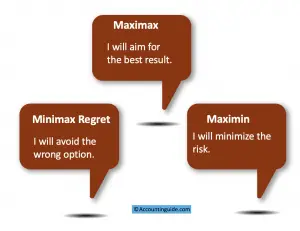

There are three different kinds of decision rules which we can found below:

1. Maximin

1. Maximin

It refers to those who willing to ignore the best outcome while trying to play defense by accepting only the project with less risk. They look at the risk (possible lost) of all results and select the one with the lowest damage. In the worst-case scenario, maximin will lose the lowest amount compared to other options.

However, he will lose the opportunity to win the highest reward. His attitude is risk-averse, as he tries to avoid the risk at all costs, even the chance to have the highest profit.

Disadvantage of maximum

Being a risk-averse will lead to defensive and conservative strategy, focus on safety by being neglect of maximizing profit. If we are playing with a defensive strategy, we will lose a chance of winning.

Moreover, he will forget about the probability of each outcome while caring only the risk impact. Sometimes the profitable option is almost guaranteed, but he may select other options with the lowest amount of loss.

2. Maximax

This person will be looking for the opportunity to increase the profit (rewards) to the maximum level by accepting any risk. He will select the best possible outcome of any option available. He is a kind of optimistic risk seeker person who aims to maximize his profit without carrying about risk.

Disadvantage of Maximax

This type of person also not looking at the probability of each outcome; he considers the possible highest amount even the chance of happening is very low.

This type of person is too optimistic, while sometimes the risk exposure is very high with a slim winning chance. He ignores everything and expects the best result will occur.,

3. Minimax Regret

It is the rule in which we try to minimize the regret from selecting the wrong option. Regret here refers to the opportunity loss due to making the wrong decision.

It can calculate as below:

Regret = profit from best option – Profit loss from not select other option

We need to build a table of regret; please refer to the illustrative below.

Illustrative of decision rule

We have the option to select one of the following projects of investment. Each project will generate different amounts of sales depend on the weather as below.

| Project | Cold ($M) | Warm ($M) | Hot ($M) |

|---|---|---|---|

| Project A | 200 | 300 | 400 |

| Project B | 500 | 300 | 600 |

| Project C | 600 | 200 | 700 |

Based on the information above, we will decide all points of view.

Maximin

Maximin will look at the lowest return from all projects as below:

- A: the lowest sale is $ 200 M

- B: the lowest sale is $ 300 M

- C: the lowest sale is $ 200 M

As a result, maximin will select project B because it will provide the highest sale in the worst-case scenario. Project A & C make only $ 200M in the same case. But he ignores the high result of $ 600M & $ 700M in project C.

Maximax

Maximax will look at the highest return from all projects as below:

- A: the highest sale is $ 400M

- B: the highest sale is $ 600M

- C: the highest sale is $ 700M

Without any question, we need to select project C which will produce the best outcome amount all projects. The project C may generate sales only $ 200M, but as Maximax, we do not look at that, we only care about the best result in the best scenario.

Minimax Regret

We need to make a table of regret to select the project. The regret can calculate as below:

- Project A: the highest outcome is $ 400M (Hot), so the regret is zero, but if the weather cold the regret is $200M ($ 400M – $200M). If it is warm, we will regret $ 100M ($ 400M – $ 300M).

- Project B: the highest outcome is $ 600M (Hot), so the regret is zero, but if the weather is cold, the regret is $ 100M ($600M – $500M). If it is warm, we will regret $ 300M ($600M – $300M).

- Project C: the highest outcome is $ 700M (Hot), so the regret is zero, but if the weather is cold, the regret $ 100M ($700M-$600M). If it is warm, we will regret $ 500M ($ 700M – $ 200M).

| Project | Cold | Warm | Hot | Total |

|---|---|---|---|---|

| Project A | 200 | 100 | 0 | 300 |

| Project B | 100 | 300 | 0 | 400 |

| Project C | 100 | 500 | 0 | 600 |

To Minimize our regret, we have to select project A, which has only a total regret of $ 300M.