What is Goods Received Note?

Goods Received Note (GRN) is a document that represents the receipt of goods by customers. It also known as a delivery note, which is used as evidence that goods are delivered and the customers already received. Moreover, both suppliers and customers use GRN to compare between order and delivery quantity.

Later on, the supplier will attach GRN with the invoice and send it to customers. It is a piece of strong evidence to prove that goods already been delivered. On the other hand, customers use this document to record inventory and accounts payable, as the invoice may arrive late and they need to record and keep track of stock.

Goods received noted also being used within the internal company as well. The goods may be transferred from factory to various warehouses in different locations. The construction material must move from warehouse to the construction site. In these circumstances, we use goods received note as the supporting document in order to prevent fraud or error. Accounting departments will require it for recording inventory transfer from place to place.

There are some problems with the goods received note as it depends on the human and human make mistake. When there are errors, it will impact the other’s work based on the level of error. To prevent human error we need to have another person double-check on the one who prepares the document. Even it is not 100% eliminate the error, but it will be able to reduce.

Goods Received Note Process

In order to understand the full process, we will briefly explain the process of purchasing material as following:

- The request person writes a purchase request with detail of the material and sends it to his head of department.

- After getting approval, the letter will be sent to the Purchase department to seek the best deal.

- Then the purchasing department will negotiate with the selected supplier for terms & conditions. They will look for the best quality product which meets the requested specification. At the same time, they also look for the best price in the market. If the materials are very subjective, they will engage the requested person to take a look at the quality.

- After that, the company will send the Purchase Order (PO) to confirm their order with the supplier. At the same time, they also pass the information (copy of PO) to the warehouse in order to confirm that the goods will be on the way soon.

- The supplier will arrange the material to deliver to the customer (usually the warehouse). They will copy all information from PO into GRN, which includes material name, specification, and quantity. It typically does not include the price in this form.

- On the delivery date, the delivery person will bring the material to the warehouse. The warehouse staff will be matching between PO, GRN, and the actual product. If all of them are a match, both parties will sign on GRN. Sometimes the quantity on GRN is less than the quantity on PO as the supplier delivers them several times.

- There are three copies of GRN, warehouse will keep one copy, one send to accountant to record stock and another copy is kept with the supplier.

- Later on, the GRN will be included with the original invoice as the billing to customers. The accountant can check the GRN to ensure that the goods are already delivered. Then they will accept the invoice and process payment base on the term.

Important of Goods Received Note

To prevent wrong delivery

The warehouse staff can use the GRN to compare with the actual product and Purchase Order to ensure the correct delivery items are correct. It will be very useful to prevent wrong delivery when the items are similar.

Save Time

The accountants can reference these documents without confirming with the warehouse regarding the delivery. The supplier also references this document to issue an invoice without calling their customers.

Prevent Fraud and Error

It will become evident for the supplier to ensure that their staff already transport goods to customers before issuing the invoice. They also confirm that the goods are not stolen broken during transportation. The customer relies on this before accepting the invoice, it will prove that they only pay for the goods that they have received.

Supporting Document for Accounting Record

There are differences between the delivery date and invoice date, so the customers will need to record inventory or fixed assets as the risk and reward already transfer. GRN is the only supporting document to support this transaction.

We need to ensure that liability is made when the company has received goods and the three ways matching is performed before payment.

Moreover, it is also the document to ensure the cut-off date which the goods have arrived. It is very important when goods arrive near the year-end, it could increase the assets and liability overnight. The date on goods receives note to determine the transaction date which accountants need to reflect into accounting system.

This problem may not exist when the delivery happens in the middle of the accounting period. But if it happens around year-end and the balance is significant, the auditor will take a closer look at the issue.

Communication between warehouse and accountant

This document is the tool which the warehouse confirms that the goods arrived. The accountant does not need to confirm by mail or phone call which can save a lot of time.

Goods Received Note Alternative

In some companies, due to the small operation, they use the invoice as the goods received note. They issue the invoice at the same time as the goods are delivered, and they ask the customers to sign on a copy of the invoice to confirm their receiving.

Some companies use the receiving report to prove the delivery, and they are not significantly different from GRN.

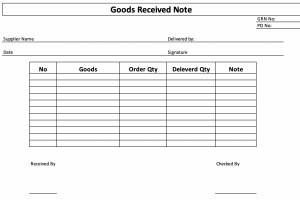

Goods Receive Note Format

Goods receive note has different formate from one company to another one depending on their design, but the main component remains the same. The relevant information for goods receive note include:

- Suppliers’ name

- Products detail such as name, type, size

- Delivery time and date

- Products’ Quantities

- Name and signature supplier’s representative

- Name and signature of receiver

- Purchase order number

Download Goods Receive Note Excel Form

Different Between goods received note and goods dispatched note (GDN)

There are many people who get confused between goods received notes and goods dispatched notes, they are completely different, please check the following comparison.

| GRN | GDN |

|---|---|

| It is the document that prepares on the customer side, usually, the warehouse department receives goods from suppliers. They need to sign on this document to ensure that the goods receive the same as the goods ordered. | It is the document prepared by the supplier before delivering goods to the customer. They want to ensure that the right goods and quantity to be delivered to customers. |

| The warehouse staff uses this document to record the inventory received. Accountant uses it to compare three ways matching before making payment to supplier. | The warehouse staff uses this to approve the movement of inventory out of the company. The sale department uses this to raise invoices to customers. |

| It is in the sequential number which allows the auditor to check the missing document. | It is in the sequential number which allows the warehouse to check the missing document and compare it with actual goods. |

| Help to prevent the payment to suppliers who have not yet delivered goods. | Help to prevent the delivery of goods without issuing invoices. |

Conclusion

Goods received note is the strong evidence to confirm that customers already receive and check all the conditions of the products. It will help both customers and suppliers to prevent fraud as the goods will be moved from suppliers to customers, they will not end up in other place or stolen. The customer will make payments to invoices which the goods have already received. The GRN should be pre-printed and keep several copies for all related parties otherwise the control will not work effectively.