Bill of Exchange

Definition

Bill of exchange is the unconditional order in writing which issue by the seller to instruct the buyer to pay a specific amount on demand at an exact time in the future. The most common type of bill of exchange is Cheque, and it will be payable on demand of the drawer after the effective date.

Features of Bill of Exchange

- The bill of exchange must be in writing, sign by both parties in order to ensure that they agree with terms and conditions.

- Unconditional: There is no bearing that can stop the drawer from drawing the money if he/she wish to do so. Like the cheque, the drawer can go to the bank to withdraw money anytime after the effective date.

- Instruct/order: Bill of exchange represent the order to pay, not the request. So the payer must process payment after drawer request.

- On-demand: The payer has to be ready for this payment as the drawer can come at any time after the effective date.

- Specific amount: the bill of exchange must state the exact amount which both parties have to settle.

- Bill of exchange should specific the beneficiary of the bill.

Parties involve in Bill of Exchange

- Drawer: is the seller who writes the bill of exchange.

- Drawee: is the person who accepts the bill of exchange, normally the buyer. He is responsible for making full payment to the seller on the due date.

- Payee: is the person who receives the payment on the bill, usually the payee and drawer is the same person. However, it can be other people such as the debtor of the drawer.

- Holder/bearer is the person who possesses the bill and highly likely the payee too.

- Endorser: can be the drawer or holder who endorses the other parties by signing on the back of the bill.

- Endorsee: is the party whose final benefits from the bill as the endorsement from the drawer.

Besides the common cheque, bill of exchange is mostly used for the international trade where the buyer and seller use the bank as the guarantee.

Why Bill of Exchange Exist?

In our normal business operation, the buyer pays cash after receive goods or services, it is easy and simple. However, due to the business expansion, some buyers may request credit terms as they need to resell the goods to final consumers. So they want to receive goods and make payments later because they do have enough money to pay in advance. This kind of customer will buy in a large quantity as they are the middle men who has high bargaining power. If the sellers reject this term, they are highly likely to lose the customers. On the other hand, the seller will risk uncollectible debt if they agree on the term.

It will be riskier if the buyers are living in other countries. At the same time, the buyer also facing the risk if he decides to make payment before accepting the goods. The seller may not ship the goods and he ends up being cheated.

Due to the difficulties of both parties, Bill of Exchange is created in order to solve the problem. The buyer will liable only after receive goods and the seller will have enough evidence to claim payment.

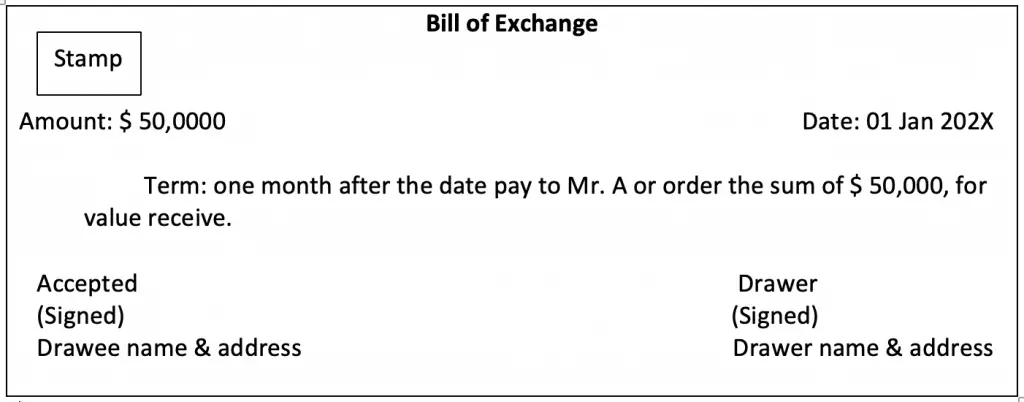

Format of Bill of Exchange

Bill of Exchange Journal Entry

Journal Entry for both seller and buyer: Both drawee and drawer must make the following entry at each stage of transaction.

| Seller (Drawer) | Buyer (Drawee) |

|---|---|

| When buyer purchase goods on credit from the seller, and goods already receive. | |

| Dr. Customer Accounts

Cr. Sale |

Dr. Inventory

Cr. Supplier Accounts |

| When valid bill of exchange issue and receipt. | |

| Dr. Bill Receivable

Cr. Customer Accounts |

Dr. Supplier Accounts

Cr. Bill Payable |

| When buyer present the bill and withdraw cash | |

| Dr. Cash

Cr. Bill Receivable |

Dr. Bill Payable

Cr. Cash |

Types of Bill of Exchange

Documentary Bill

This is the common method of international trade when the seller cannot receive any advance payment. The buyer is not feeling comfortable to pay before the goods ship, so the best solution is a documentary bill with the bank. The bank will require the buyer to deposit money and will only release the money to the seller after the buyer satisfies the purchase agreement.

Demand Bill

It is a bill which must be paid when the payee proceed. In order words, the payee will receive the payment after presenting the bill as there is no specific time on it.

Usance Bill

This bill will be cleared within a specific time that put on it. The effective date can be the date on bill of landing or the date which drawee acceptance. It can be different depending on the term on the bill.

Inland Bill

This is the bill which can only use within a country or state, it will be invalided when the transactions are a crossed the countries.

Clean Bill

The bill does not require any supporting document so it leads to a very high-interest rate.

Foreign Bill

The bill mainly uses for the purpose of import and export. As the name suggests, it can be operated from one country to another. The drawer and drawee is a citizen of two different countries. It will be a liability in the country when they withdraw payment in another country.

Accommodation Bill

The drawer and drawee accept and drawn this bill without related to any trade transaction which involves sale/purchase of goods or service. They agree on terms and conditions to provide financial support to one or both parties.

Trade Bill

Besides the main feature of the normal bill, the holder of this bill can trade it in the market. It works as a financial instrument. The bill is drawn and accepted to settle the trade transaction.

Supply Bill

This bill can only be used by the government who wish to make payment to supplier or contractor.

Advantages of Bill of Exchange

Legal evident

The seller known as the drawer has the ability to sue the buyer in case of insufficient funds. Different from normal accounts receivable, the bill of exchange has strong evidence in the court to sue the drawee.

Trade as an instrument

The holder can trade the bill as a financial instrument by sell at the discount to third parties. However, it must have complied with the type of bill which we mention above.

Encourage international trade

Bill of exchange has prevented the risk of fraud for both sellers and buyers. Both parties have confidence in doing international trade.

Resolve Cash Flow Problem

The buyer will have enough time to prepare cash to pay the supplier as it will require buyer to pay at a certain time in the future. At the same time, seller can use this bill to pay their debt.