Debit Voucher, Credit Voucher, and Transfer Voucher

Voucher is the supporting documents that accountants use as the summary to record into the accounting system. It is the primary document to prove that the transactions have occurred, it is used to record payment, receipt, and journal adjustment. The voucher contains the reference number which allows to trace back and forth between accounting record and supporting documents.

The voucher helps accountant to arrange the business transactions into the category of revenue, expense, and other adjustments. Accountants can prepare the document by month which is easy to find the document if need.

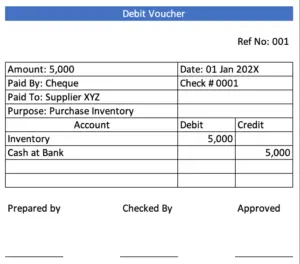

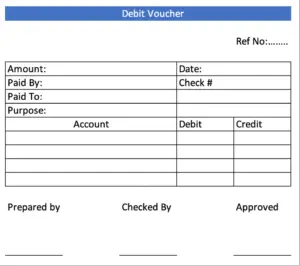

Debit Voucher

A debit voucher or payment voucher is the supporting document that shows that the monetary transaction has occurred. It shows that the company has made payment to its supplier and other parties. This payment voucher will be used for both cash and bank transactions. The company will use a payment voucher for the payment of payroll, utilities, rental, purchase of goods, and so on. One voucher will be used for one business transaction.

Debit Voucher template

Documents attach with debit voucher

Each voucher represents a separated transaction, so the documents attached may be different due to their nature,

- Method of payments: If we pay by cheque, it should attach the copy cheque with the sign of the receiver. If the payment makes by cash, we must ask for the official receipt as proof of payment. Some transactions may make through bank transfer, it is optional to attach the transfer slip as we can see the detail in the bank statement.

- Original invoice: The original invoice must attach with a payment voucher to prevent double payments. The invoice must also stamp paid to prevent someone from using it to process the payment again on purpose. The name on the invoice must be the same as the name on the cheque or receipt

- Purchase Order: The company will only pay for any purchase which already approved by the purchasing department.

- Goods Received Note: It helps to ensure that the payment is made to the supplier only after the goods are received.

- Contract: not all transactions, if we have a contract, we must attach to ensure the payment has complied with the term in a contract.

Debit Voucher Example

For example, company ABC purchase inventory cost $ 5,000. The payment is made on the same day using the cheque. Please prepare a debit voucher for the transaction.

Credit Voucher or Receipt Voucher

Credit or Receipt Voucher is the supporting document that shows the company has received cash from their customer, bank, or other parties. This voucher can be used for cash receipt from the sale, share capital injection, Interest earns from bank, cash receipt from the debtor, and cash from other sources.

Some companies use receipt vouchers to record the individual transactions of sale only.

Document attach with Credit Voucher

- Cash receipt: It can be the cheque, cash or bank transfer. Similar to debit voucher, we need to have a copy of supporting documents to prove that cash already receipt.

- Contract: for the transaction such as capital injection, construction revenue, the copy contract should be attached.

Non-Cash Voucher

Non-Cash voucher is the voucher for other transactions which is not involving with cash flow, it is also known as the journal vouchers. Some transactions such as, deprecation, credit sale, credit purchase, adjustment, and reversing entries.