Holding Period Return

Holding period return is the total return from the investment during the compaany’s ownership. The investment can generate two sources of income such as interest, dividend and capital gain. The income can be interest income from the bond, dividend from stock. While the capital gain happens when the selling’s market value is higher than the initial cost.

The holding period return can present in both a time-weighted or money-weighted rate of return. It enables users to compare investments in different companies.

Holding period return is the basic function for management to access the investment project. It gives the overall view of investment performance over its lifetime. Rather than access over each year’s performance, it provides the full picture of the investments.

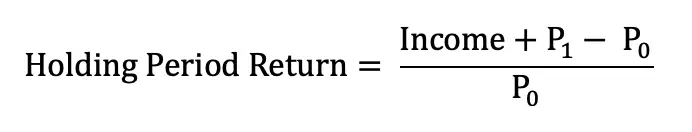

Holding Period Return Formula

- Income: The interest or dividend from investment

- P1: Initial Value

- P0: Ending Value

Holding Period Return Example

Five years ago, Company A invests $ 100,000 in the share capital of company X. Each year, the company receives a dividend from company X. Company A receives a total dividend of $ 10,000 from the first year up to now. At the end of the year Company decides to sell all shares for $ 120,000.

Please calculate the holding period return for these shares.

Holding Period Return = (10,000 + 120,000 – 100,000)/100,000 = 30%

It means that company A can make 30% over the holding period of this investment.

Advantages of Holding Period Return

| Advantages | |

|---|---|

| Easy to calculate | The holding period return is easy to calculate. We take the figure and put it into the formula. The data are also easy to find. |

| Include both return | This ratio includes both returns, which reflect the real return investors receive. |

| Comparable | The concept allows the investor to compare one investment to another and find the highest return. |

| Easy to analyze | The higher the return investor receives, the better investment is. We simply refer to the highest profitable investment. |

Disadvantages of Holding Period Return

| Disadvantages | |

|---|---|

| Exclude Time Value of Money | This method does not include the time value of money. It assume the value of P0 and P1 is the same, it does not discount the future value. |

| Stock Price Speculation | Stock price does not really reflect a real return, and it may subject to speculators. The price will change depending on supply and demand. So it allows the big player to drive the price base on their interest. |

| Based on the past data | The return base on the past data may not reflect the future. It is tough to use this ratio to predict the future or make an investment decision. |