Provision Expense

Overview

Provision expense is the expense that the company, such as bank or microfinance institution, makes to cover the anticipated losses that it may occur due to default loans and receivables. In this case, recording the provision expense makes the company’s assets reflect its actual economic value as well as having a more realistic view of its net profit figure.

Likewise, it is necessary for the company to make the provision expense, if they have non-performing loans, to have a better view of the actual performance and profitability regarding the loan portfolio quality. The provision expense usually decreases when the company achieves an improvement in overall loan portfolio quality.

Provision expense is usually directly related to the credit risk that the company exposes to. In this case, the portfolio at risk and risk coverage ratio may be used to determine whether the provision expense appropriately reflects the company’s credit risk or not.

It is important for the company (especially the credit department) to appropriately manage and monitor the company’s credit risk so that the estimated loan losses match the actual loss they would incur, in a material respect.

Provision Expense Journal Entry

In accounting, after estimating the loss that it may suffer due to the defaulting loans, the company can make the journal entry of provision expense by debit provision expense and credit loan loss reserves.

| Account | Debit | Credit |

|---|---|---|

| Provision expense | 000 | |

| Loan loss reserves | 000 |

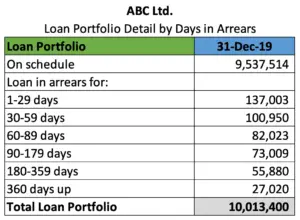

For example, the company ABC Ltd. which is a microfinance institution has the loan portfolio of USD 10,013,400 and the loan portfolio detailed by days in arrears as below:

ABC Ltd. has the policy to calculate the provision of the defaulting loans by using the rate below:

- Loans that are in arrears from 1- 29 days, provision 3% of the loan balance

- Loans that are in arrears from 30 – 89 days, provision 20% of the loan balance

- Loans that are in arrears from 90 – 179 days, provision 50% of the loan balance

- Loans that are in arrears from 180 days onward, provision 100% of the loan balance

With the above information, calculate the provision that the company needs to provide for the loan portfolio above.

What is the provision expense journal entry that the company needs to record?

Solution:

With the financial information above, we can calculate the provision for the loans as below:

| Loan Portfolio | 31-Dec-19 | Provision % | Provision |

|---|---|---|---|

| On schedule | 9,537,514 | 0% | – |

| Loan in arrears for: | |||

| 1-29 days | 137,003 | 3% | 4,110 |

| 30-59 days | 100,950 | 20% | 20,190 |

| 60-89 days | 82,023 | 20% | 16,405 |

| 90-179 days | 73,009 | 50% | 36,504 |

| 180-359 days | 55,880 | 100% | 55,880 |

| 360 days up | 27,020 | 100% | 27,020 |

| Total Loan Portfolio | 10,013,400 | 160,109 |

So, with the calculation above, the company needs to make a provision of USD 160,109 for the loan portfolio of USD 10,013,400.

In this case, we can record the journal entry of provision expense as below:

| Account | Debit | Credit |

|---|---|---|

| Provision expense | 160,109 | |

| Loan loss reserves | 160,109 |

It is useful to note that the provision expense journal entry above should be recorded after we have reversed the previous provision first. For example, if we had the provision expense of USD 125,360 in the previous period, we should reverse such amount first before recording the above journal entry. We can reverse the provision by debiting loan loss reserves and crediting provision expense.

Note:

The percentage of the provision that we use above is just an example. Usually, the local national bank or tax law requires regulated financial institutions to follow a certain way of calculation of provision or impairment of loan portfolios. And such calculation may require the minimum rate that the company needs to maintain as its loan loss reserves.

For unregulated institutions, a variety of provision expense practices may be used. In this case, the provision is usually made in a way that shareholders or board of directors deem appropriate in response to the estimated losses from the loan portfolio.